Discover which products suit your preference and budget. Enter your preferences and receive an instant tailored recommendation.

Investing in gold bars

Why invest in gold bars? Many individuals are seeking ways to protect their purchasing power and safeguard their wealth. Bank interest rates are currently relatively low, making holding savings unattractive. Because gold has served as a form of currency and a hedge against the erosion of purchasing power for over 6,000 years, purchasing physical gold bars is a suitable alternative for saving money.

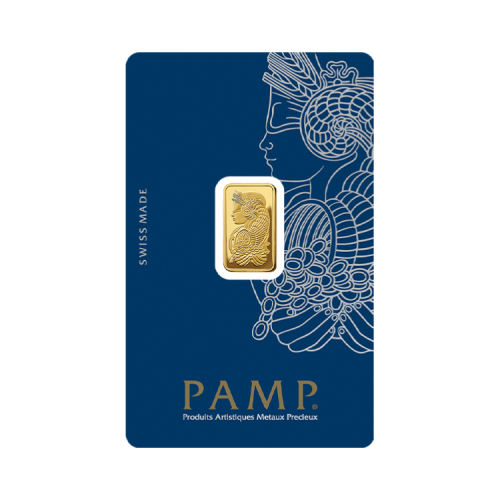

When investing in gold bars, it is important to opt for standard gold bars from recognized producers. This ensures their worldwide tradability without the need for analysis. These gold bars are struck in weights ranging from 1 gram to 1 kilogram.

Gold bars are typically struck in 99.99% pure gold, and their value is based on the most current gold price. Investing in gold bars is possible at a price only a few percent higher than the current gold price.

Why invest in a gold bar instead of coins?

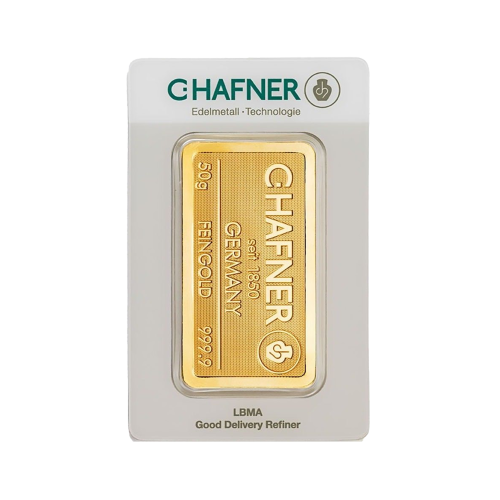

The most common consideration for purchasing gold bars instead of gold coins is pricing. Gold bars are often cheaper to produce than gold coins, resulting in a lower price per gram and thus a lower purchase price. This is especially applicable to gold bars of 50 grams or more.

The larger the gold bar, the lower the price per gram. This is because the production costs for larger gold bars are proportionally lower than for smaller ones. The most common gold bars are those of 1 troy ounce (31.1 grams), 50 grams, and 100 grams. The price per gram of smaller gold bars is higher, but they are more accessible than larger denominations, which may be less straightforward to sell in the future.

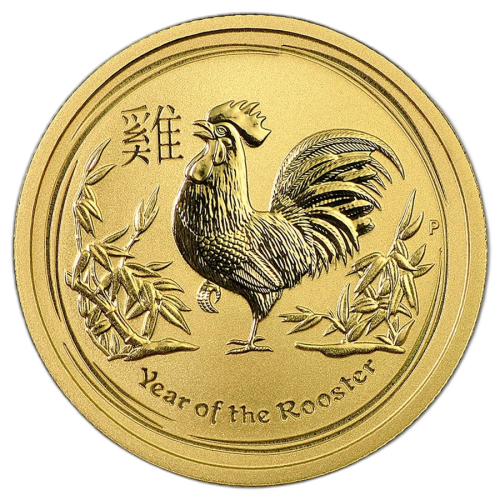

Gold coins are mainly purchased by individual investors and savers who wish to invest in smaller denominations. After all, it is not possible to break down a gold bar and sell pieces of it individually.

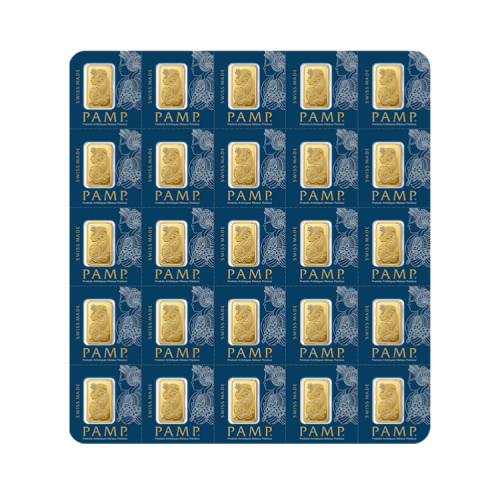

However, you can choose to purchase combi-bars. These are gold bars designed to resemble a chocolate bar, with the gold being divisible into small 1-gram blocks. Because these combi-bars are produced differently from individual 1-gram gold bars, the production costs are relatively lower, and you can sell them in parts.

Making the right choice when you buy gold bars

When purchasing gold bars, there are two ways to determine which gold bar best suits your needs. The most straightforward method is to consider the price of the gold bar and then calculate the price per gram. You can calculate the price per gram by dividing the price of the gold bar by its weight. The lower the price per gram, the cheaper the gold bar is in proportion. Another method is to consider the spread, which refers to the difference between the purchase price and the sale price of gold. The lower this difference, the more favorable it is.

Furthermore, the choice of gold bars is limited by the available budget. At the time of writing, a kilogram of gold is worth over €69,000, making it inaccessible to everyone. Additionally, it is a matter of whether it is wise to spend the entire purchase amount on the largest possible gold bar or whether it is more advantageous to purchase several smaller gold bars. This provides the opportunity to sell some of the gold bars in the future.

On our website, you can consult the Buying Guide to determine the most interesting choice. The Buying Guide takes into account both the price per gram and the spread and determines the most interesting solution in real-time.

Gold bars from recognized producers

All gold bars offered by The Silver Mountain are struck in at least 99.9% pure gold. This is also a requirement for gold to be used as investment gold. The advantage of this is that when purchasing investment gold, you do not pay VAT. This makes buying gold bars considerably cheaper compared to other forms of gold.

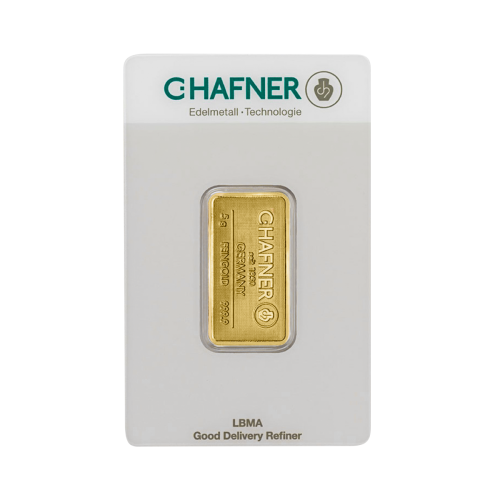

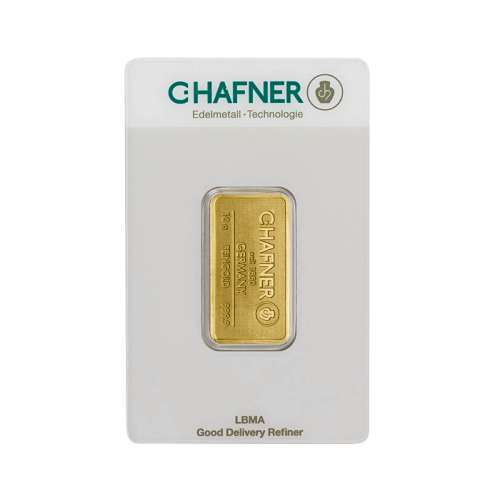

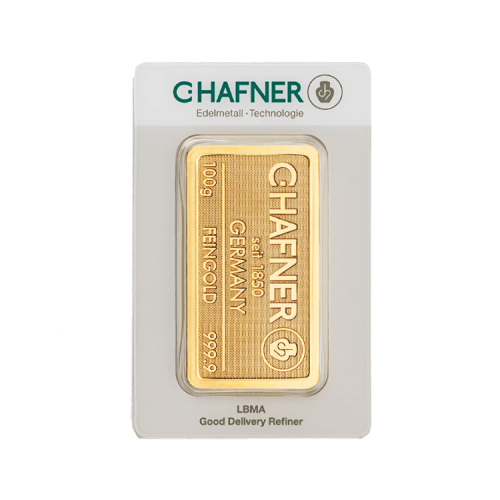

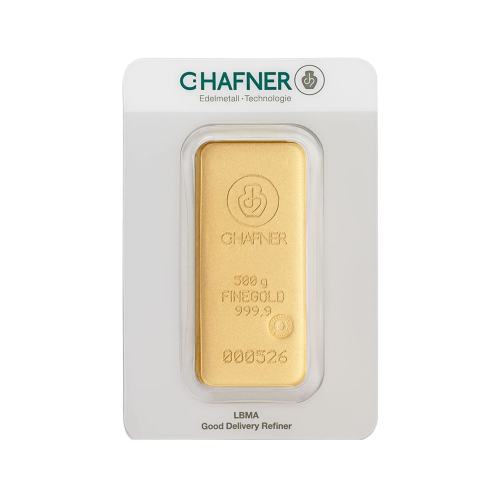

The origin of gold bars is an important indicator of whether the respective gold bar is easily tradable worldwide. The London Bullion Market Association (LBMA) determines which refineries receive Good Delivery Status and ensures that all gold bars from these refineries meet high-quality standards. The Silver Mountain exclusively trades in gold bars from such refineries. The most common gold bars in the Netherlands originate from Umicore and C. Hafner.

All gold bars from recognized producers are in mint condition. Most producers choose to deliver their gold bars with a certificate of authenticity, often in the form of blister packaging. This certificate includes the unique serial number, also known as the bar number. In addition to the bar number, the weight and gold content are also displayed on both the gold bar and the certificate.

Buying gold bars with buyback guarantee

The Silver Mountain offers its customers a unique buyback guarantee. This means that you can always sell back your precious metals to us. Through our subsidiary company Inkoop Edelmetaal, it is possible to sell gold bars easily and quickly. When selling gold bars, we offer fixed bidding guarantees and a buyback guarantee.

We always buy back your gold bars

All gold bars can be sold at Inkoop Edelmetaal for at least 98% of the current gold price. On the Inkoop Edelmetaal website, bidding prices are automatically calculated every three minutes based on the most recent gold price.

For gold combi-bars, our bidding price is higher, and we pay 100% of the current gold price. This is because it is a popular product that is easy to trade.

Buyback guarantee

The buyback guarantee means that we guarantee that we can always repurchase your gold bars through our subsidiary Inkoop Edelmetaal, regardless of market conditions. We do this at fixed formulas, so there is no ambiguity about the amount of our bidding price. There is no limit to the number of gold bars you want to sell, and all sales orders are usually processed and paid within a few working days.

The buyback guarantee combined with the bidding guarantees provides security when buying gold bars. A standard spread (difference between buying and selling) in the gold trade ranges from 2.5% to 5%, depending on the size of the gold bar.

Storing gold bars

Gold bars are valuable, and gold is a fragile precious metal. Therefore, it is important to store your gold bars in a safe place. One consideration is whether you would like to store the gold at home or externally.

Gold has a high value per gram and a high density. As a result, a 1-kilogram gold bar is smaller than the average mobile phone. In that regard, it is easy to store the gold at home in a secure place, but it is a personal decision whether this is desirable. Additionally, it is often not possible or very expensive to insure the gold stored at home. A common solution is to store the gold with a specialized company or to store it partly externally and partly at home. You can store your gold at our subsidiary Edelmetaal Beheer Nederland.

Edelmetaal Beheer Nederland specializes in the storage of physical gold. It is possible to store gold in the Netherlands or in Switzerland. In all cases, the gold is stored fully insured, and each gold bar is registered in the name of the owner. This means that there is allocated storage where there can be no dispute about the ownership of the gold.

The inventories in the vaults of Edelmetaal Beheer Nederland are audited twice a year by an independent accountant. During this audit, you will receive a report confirming that your gold is physically present and fully insured. You also benefit from the buyback guarantee and can easily sell the gold back when desired without physically retrieving the gold from the vault and returning it to us. Through authorization, you can give Edelmetaal Beheer Nederland permission to deliver the gold from your vault space to The Silver Mountain.

Frequently asked questions about gold bars

What are gold bars?

Gold bar is another word for gold stick. It is an often rectangular-shaped block of pure gold. A gold bar is produced by a smelter and gold bars always contain pure gold, at least 99.5% as gold content. Gold bars from recognised producers always show the weight and content. Often, a gold bar also has a unique bar number. This is a serial number through which the gold bar can be identified. The gold bar also displays the logo of the smelter.

What are the cheapest gold bars?

The gold bar with the lowest price is the 1 gram gold bar. An important note here is that production costs are often very low with such small gold bars, so it is generally wiser to buy a gold bar in a higher weight. The cheapest gold bar in relation to the gold price is the 1 kilogram gold bar. This is a gold bar that can be bought at a premium of typically only 1% above the gold price. This makes it the gold bar with the lowest price per gram. However, the size of 1 kilogram is such that the 1-kilogram gold bar is a very expensive product and represents a market value of currently around €69,000.

What are important considerations when buying gold bars?

Always read up carefully first when you want to buy gold bars. After all, buying gold is not an everyday occurrence for everyone and involves high purchase amounts. Would you rather buy gold bars or gold coins?

Gold bars are cheaper compared to gold coins. This has to do with production costs. The larger the gold bar, the lower the premium. Do you want to sell your gold in instalments over time? Then gold coins may offer more flexibility.

To best help you with your gold purchase, we have a Choices Guide to help you determine the best choice based on your purchase amount.

Buying gold is usually done for the long term, i.e. for an investment horizon of at least 5 to 10 years.

Which weight should you opt for?

The weight of the gold bar that best suits your needs depends on your own preference. Gold bars can be bought from 1 gram up to 1 kilogram.

If you want more flexibility, then perhaps the gold combibars could be a good option for you. This gold bar is produced just like a chocolate bar and breaks down into small gold bars of 1 gram. Gold combibars are available from 10 x 1 gram up to 100 x 1 gram.

In the Netherlands, the most common gold bars are the 50-gram and 100-gram variants. Internationally, the size of 1 troy ounce (31.1 grams) is also very common.

Are gold bars subject to VAT?

VAT is not paid on investment gold, provided it was minted after 1800, is at least 90% pure gold and - in the case of coins - it is or has been legal tender in the country of origin. Gold coins and gold bars are VAT-free. However, investment gold is part of your assets and you should declare the ownership of gold in Box 3.

Will I receive a certificate of authenticity with my gold bar?

Most newly minted gold bars come with a certificate of authenticity. Depending on the producer, this may look different. Gold bars sourced from Umicore and C. Hafner come in a blister pack that serves as a certificate. The packaging shows a unique bar number, a signature and logo of the smelter. The serial number can also be found on the gold bar itself.

You can filter our range of gold bars by new gold bars with a certificate of authenticity, and the specifications on the product page also indicate for each gold bar whether it comes with a certificate of authenticity.

How is the gold delivered?

There are various options for shipping your gold. With our personal delivery service, your gold is insured and discreetly handed over to you, but you can also choose to collect the gold yourself in Baarn or The Hague by appointment. A final option is to have your bought gold bars stored at Edelmetaal Beheer Nederland (EBN). Here, all orders are allocated, insured and securely stored.

-ekAgc6qt-dLcPLQf4-small_thumb.png)