Discover which products suit your preference and budget. Enter your preferences and receive an instant tailored recommendation.

Experienced and reliable

Why buy gold at The Silver Mountain

Buy-back guarantee

Buy-back guarantee

Guaranteed buyback option with a fixed bid price guarantee, regardless of volume and market price.

Trusted for 15 years

Trusted for 15 years

Established in 2008 and now the largest coin dealer in the Netherlands with a customer rating of 4.8/5.

Recognized and respected

Recognized and respected

Gold sourced from recognized LBMA Good Delivery refineries, minted in at least 99.9% pure gold.

Authenticity verification

Authenticity verification

We guarantee the authenticity of our products and provide a certificate of authenticity with every purchase.

Knowledge center

Knowledge center

Safe Online Gold Purchasing

Since our establishment in 2008, we had a clear goal in mind: to make the purchase of physical gold and silver accessible, safe, and transparent.

We have since grown to become the largest and most reliable bullion dealer in the Netherlands. Nearly 4,000 customers have rated us 4.8 out of 5.

Choice guide

Smart investing

When choosing the right products, we advise considering both the price per gram and the spread. The price per gram indicates which product is most cost-effective to purchase, while the spread shows the difference between the buying and selling prices. Typically, pre-owned coins are an interesting option, and for larger purchase amounts, gold bars of 50 or 100 grams are common.

Buy gold safely

When buying gold, there are a few important things to consider. Our team at The Silver Mountain is ready to provide professional advice.

Buy gold from a reliable source

It is important to buy gold from a reliable source. A producer is only recognized if accredited by the London Bullion Market Association, better known as the LBMA. The LBMA issues the Good Delivery List annually. If a producer is on this list, it is confirmed that the gold they produce is at least 99.9% pure.

The Silver Mountain only offers gold from recognized producers. We only work with official mints and gold refineries with Good Delivery Status. We offer a buyback guarantee with every order and provide a proof of authenticity.

The Silver Mountain is licensed by the Dutch Authority for the Financial Markets (AFM) to offer gold and silver as investment objects.

Buy gold with certificate

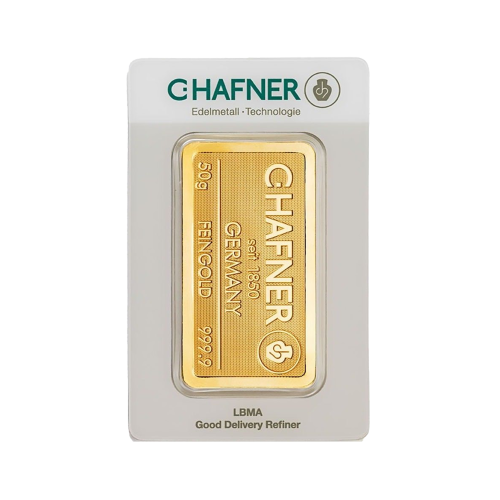

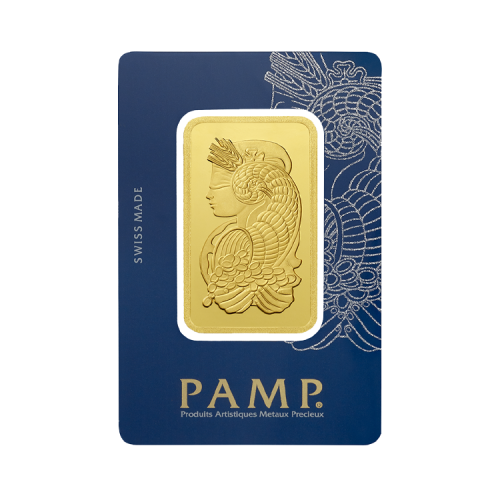

New gold bars from producers such as Umicore and C.Hafner are delivered in protective blister packaging, which also serves as a certificate of authenticity. This certificate displays the serial number of the gold bar and confirmation from the refinery that it is 99.99% pure gold.

Gold is not always delivered with a certificate. For example, gold coins are struck without a unique serial number. For this reason, a certificate cannot be linked to a unique coin. Official mints do not issue certificates for their gold coins. If you ever sell gold coins, a certificate will not be requested. Newly minted gold bars, on the other hand, are often delivered with a certificate. It is indicated for each product whether the gold is delivered with or without a certificate.

Depending on the producer, the certificate may be a separate document or the blister packaging serves as the certificate. The packaging displays the unique serial number of the gold bar with a signature from the refinery. Gold bars from C. Hafner and Umicore, among others, are delivered in this manner. The advantage of buying gold with a certificate is that it is easier to trade among individuals.

Buying Gold Safely and Securely

It's also important to receive gold in a secure manner. All orders at The Silver Mountain are processed in a specialized and secure external warehouse. Here, all packages are weighed and packed under camera surveillance in accordance with strict insurance conditions. All packages are discreetly packaged, without any mention of our trade name or other factors that could reveal the contents of the package.

All shipping methods offered by The Silver Mountain are always fully insured. As an online consumer, you are also legally protected: should a package be lost during transport, we will arrange for a replacement shipment or refund the full purchase amount.

Recommended! For shipments within the Netherlands, The Silver Mountain uses its own delivery service via a house courier. The house courier delivers packages only after an ID check and only to your specified delivery address. You will receive advance information about the delivery date and time window, which can be adjusted in consultation. Our house courier has a 100% success rate and guarantees a safe, discreet delivery. Moreover, our couriers drive unmarked vans without logos.

Should I buy gold coins or goldbars

A common question is whether it's better to buy gold coins or gold bars. There are differences between these two forms of gold, but they also have similarities. Both are considered investment gold, meaning you can buy and sell gold without VAT globally. When the gold comes from a recognized producer and is 99.9% pure, it is considered a sound investment.

Gold Bars

When considering the price per gram, gold bars are generally cheaper to purchase than gold coins. Gold bars are minted in various weights, from 1 gram up to 1 kilo. The production costs of larger denominations are relatively cheaper.

The production costs for a single 100-gram gold bar are significantly lower than the costs for producing 100 1-gram gold bars. The most commonly sold gold bars are those of 1 troy ounce, 50 grams, and 100 grams.

While gold bars are cheaper to purchase initially, you cannot divide them into pieces to sell. This means that when investing in gold, you should consider the denominations in which you buy it. Diversifying with multiple sizes of gold bars provides flexibility, as larger bars will be cheaper to purchase while smaller bars are easier to sell.

Smaller gold bars have the advantage that you don't have to exchange all your gold at once if you decide to sell some or all of it. In that case, you're relatively more expensive in terms of purchase. To be both flexible and purchase gold at low costs, you can opt for combination bars. These bars, like a chocolate bar, can be divided into smaller denominations that are easier to trade – specifically aimed at providing flexibility and a low price per gram.

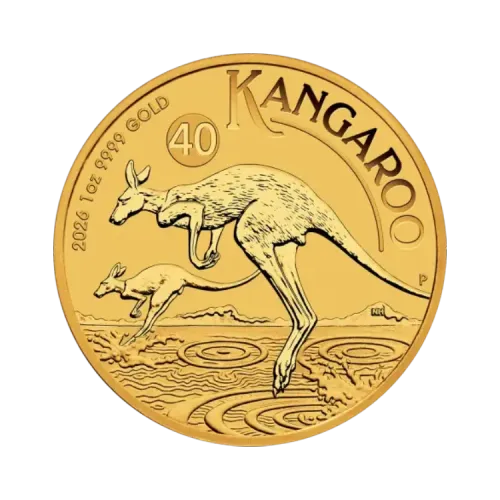

Gold Coins

Many individual investors who buy gold opt for 1 troy ounce - 31.1034 grams - investment gold coins. A troy ounce is the global standard for gold that is 99.9% pure. Examples include the gold Maple Leaf and the gold Krugerrand. Compared to gold bars, there are higher premiums for gold coins, but you also receive a higher bid price when selling in the future. The advantage of coins is their ease of trade. Gold coins like the Maple Leaf and the Krugerrand are globally well-known and easily tradable everywhere.

If you want to purchase gold for a smaller amount, fractional gold coins are a good choice. Fractional coins are minted in a fraction of a troy ounce, such as half a troy ounce or a quarter troy ounce. At The Silver Mountain, gold coins are available in 1/2 troy ounce, 1/4 troy ounce, and 1/10 troy ounce.

Why buy physical gold

For over 6,000 years, gold has been utilized as real money. Throughout history, amidst various monetary systems, one form has consistently preserved its value: gold.

Since the last financial crisis, trust in unbacked monetary systems like the euro and the dollar has diminished. Gold, on the other hand, has a good reputation for safeguarding purchasing power, and its value is generally highly stable.

Today, central banks still maintain significant gold reserves, and in recent years, many central banks have repatriated their gold reserves from abroad or even expanded them further.

Physical gold is increasingly popular, even among smaller private savers and investors. Buying gold is usually motivated by three reasons:

Diversification of Investments

Buying gold as an investment primarily seeks an increase in the gold price. Additionally, purchasing gold can ensure a good balance in an investment portfolio. If other assets perform poorly, holding gold can usually offset this. During times of financial uncertainty, it's interesting for investors to diversify investments and convert a portion into gold. Since 2008, the average increase in the gold price has been around 8.5% per year (measured in euros). Many savings rates lag behind this, and compared to the return on stocks, such an increase is relatively high. Therefore, gold offers a favorable return.

Adding gold (and other precious metals) to an investment portfolio also helps diversify risks. Precious metals are not heavily dependent on other assets, allowing them to increase in value while stocks, bonds, or currencies decline.

A general recommendation suggests that allocating 10% of an investment portfolio to buying gold would be significant enough to offset losses elsewhere. The greater the uncertainty in financial markets, the more compelling it becomes to opt for a larger percentage for purchasing gold.

Most people who buy gold do so with an investment horizon of at least 5 to 10 years. Despite gold being initially a defensive purchase - to preserve wealth - recent periods have shown that the gold price can rise significantly.

Buying Physical Gold as a Safe Haven in Times of Uncertainty

A second reason for choosing to buy physical gold is financial security. Gold is a rare and valuable precious metal valued by people worldwide. Therefore, owning physical gold is interesting; it can always be used as a medium of exchange.

Moreover, owning physical gold is safer than holding gold trackers or ETFs (Exchange Traded Fund). Here, you not only deal with an intermediary, bank, or broker, but often it's not possible to physically deliver the gold. An important saying in the gold market is "if you don’t hold it, you don’t own it." Buying physical gold thus entails fewer risks and less dependence on the fiat money system.

By choosing gold, your wealth is protected against the instability of current financial systems. While savings rates cannot compensate for inflation, the gold price does.

In times where cash is increasingly disappearing and money systems are becoming more digital and abstract, physical gold in the form of gold coins and gold bars offers the opportunity for autonomous trading.

Buying Gold as Protection Against Inflation

Inflation is often referred to as the silent killer of your capital. Inflation leads to a significant decrease in purchasing power. By buying gold, you secure a portion of your wealth. Gold maintains its intrinsic value and thus its purchasing power. The actual value of gold has always remained very stable. With a gold coin of 1 troy ounce, one can buy the same amount of goods as 100 years ago. The purchasing power of today's currencies, on the other hand, has significantly declined over the past century.

In the past 10 years (2014 to 2023), the inflation rate in the Netherlands averaged 2.55%. With an average annual inflation rate of 2.55%, the purchasing power of wealth decreases by about 50% within a period of 27 years.

When you buy physical gold, you are not dependent on banks, the deposit guarantee scheme, or the survival of today's currencies. Whereas money systems were previously backed by a gold standard, nowadays money is issued without its value being backed by gold. All the money currently in circulation is thus created as debt, resulting in high inflation and the erosion of the value of this money. By buying physical gold, you protect your wealth and purchasing power.

Gold pick-up or delivery

When you purchase gold from The Silver Mountain, you have various options to obtain the gold. You can choose to pick up your gold, have it delivered, or store it.

Pickup

If you wish to pick up your purchased gold, you can do so at one of our office locations in Baarn or Den Haag. Select the option 'Pickup by appointment' at checkout in the webshop under shipping methods. Gold pickup is strictly by appointment only, and you must bring a valid identification for the visitors' register.

Delivery

We offer multiple delivery options. You can have your gold shipped via PostNL, but we also have an in-house courier specialized in valuable shipments. With our in-house courier, you can choose between daytime or evening delivery. All our delivery options are insured, and through identity verification, we ensure that your gold is delivered only to you.

Storage of gold

It is possible to store gold at home, but you can also choose to store your gold in an external vault. At The Silver Mountain, you can opt for our sister company, Edelmetaal Beheer Nederland (EBN), where your gold is stored in heavily secured vaults under AFM supervision. This is done fully allocated, meaning each piece of gold is registered in your name and insured.

EBN's storage locations are fully insured and meet the highest security standards. In the Netherlands, we collaborate with Dutch Value Logistics, a sister company of the Royal Dutch Mint. Various precious metals can be stored here.

In Switzerland, storage is possible with Loomis International, the global leader in the storage of physical precious metals. EBN also has a customs depot at Loomis, making it possible to store white precious metals (silver, platinum, and palladium) without paying VAT. Storing gold in Switzerland is also an option, with Switzerland being one of the largest countries in the gold market, making buying and selling extra accessible.

The inventories at EBN are audited twice a year by an independent accountant, verifying both the physical inventory and the insurance policy. Your gold is securely protected in storage, and you can request your gold at any time.

When you request your gold, it may take up to a week before you can pick it up at our office address in Baarn. We do this to ensure the safety of your gold. Alternatively, you can choose to have your gold delivered to your home.

What to consider when buying gold

When safely purchasing gold, there are several factors to consider. We have summarized the most important points for you.

Seller

When deciding to buy gold, it's important to choose a reputable seller. Sellers with an AFM license and producers recognized by LBMA adhere to high-quality standards. The reliability of the seller can also be evidenced by (online) reviews, accessibility, and availability.

Gold coins and gold bars

When deciding to buy gold, it's important to know the differences between coins and bars. Gold coins are sold at a higher premium compared to gold bars. Therefore, they are more expensive to purchase, but they are easier to trade than gold bars. In comparison, gold bars are cheaper to purchase and are available in various denominations, from 1 gram to 1 kilo.

Buy genuine gold

Finally, it's important to purchase an authentic product.

With the most common gold bars, a certificate of authenticity is included. With all orders from The Silver Mountain, proof of authenticity is provided, and you can take advantage of our unique buyback guarantee. On the product page, you can also see the dimensions and weights of the gold coin or gold bar. There should never be any discrepancies in these properties. You can easily verify these characteristics yourself. Gold coins or bars from unknown producers, or offered at too low a price, are better to avoid. Typically, common coins and bars are available at a premium of a few percentage points above the gold price. If you can buy gold somewhere at a discount, below the gold price, it's often not legitimate.

Want to know more about common mistakes when investing in gold? Rolf van Zanten, owner of The Silver Mountain, explains in the video below.

Frequently Asked Questions About Buying Gold

What should you consider when buying physical gold for the first time?

Focus on the purity, origin, and liquidity of the gold you purchase. Choose LBMA-accredited gold coins or bars to ensure global tradability and a minimum fineness of 99.9%. This helps guarantee authenticity and broad market acceptance.

What is the difference between gold coins and gold bars?

Gold coins are typically more liquid, while gold bars offer a lower premium per gram. Coins have a lower entry price and are easy to diversify with. Bars are more cost-efficient for larger investments due to reduced production costs. Your choice depends on your budget and desired flexibility.

How is the price of physical gold determined?

The price of gold is based on the international spot price, which fluctuates continuously due to global supply and demand. The final product price includes the intrinsic gold value plus a premium that covers refining, manufacturing, and distribution costs. Prices on our website update automatically with the live gold rate.

Is physical gold considered a safe investment?

Physical gold is widely regarded as a stable store of value and a hedge against inflation and economic uncertainty. It maintains global recognition, is independent of banks or digital systems, and plays a role in portfolio diversification. Keep in mind that gold prices can still move with market conditions

Can I store my gold securely instead of keeping it at home?

Yes, you can store your gold securely with Edelmetaal Beheer Nederland (EBN), our specialized partner for fully insured precious-metal storage. Your holdings are stored with individual allocation, maximum security, and complete ownership separation. Professional storage is often preferred for larger investments or additional peace of mind.

How quickly is physical gold delivered after placing an order?

If products are in stock, orders are typically shipped within one business day. You can choose insured home delivery or collection by appointment. Delivery times depend on stock availability and the selected shipping method.