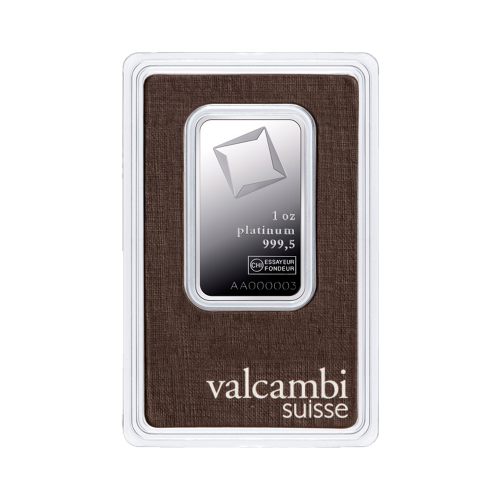

Purchase platinum bars

In addition to coins, you can also purchase platinum bars from us. We offer these in combination with storage at Edelmetaal Beheer Nederland (EBN) in the bonded warehouse in Zurich, Switzerland. The major advantage of this arrangement is that you do not pay VAT on your purchase, making it significantly more cost-effective than having a platinum bar delivered in the Netherlands.

When considering an investment in platinum, it is important to be aware of the applicable tax regulations, particularly VAT (value-added tax). In the Netherlands, platinum is subject to 21% VAT, which can have a significant impact on your total investment.

VAT on Platinum

VAT, or value-added tax, is a tax levied on the sale of goods and services. In the Netherlands, the standard VAT rate is 21%. This also applies to the purchase of platinum in the form of bars, making the acquisition of platinum in the Netherlands more expensive due to the additional tax costs.

Benefits of VAT-Free platinum

One way to avoid the costs associated with VAT is to purchase platinum with storage in a bonded warehouse outside the Netherlands, such as in Switzerland. Here are some benefits of buying VAT-free platinum:

Cost Savings

By purchasing platinum and storing it in a bonded warehouse in Switzerland, you save the 21% VAT that would normally apply upon import into the Netherlands. This can significantly reduce your total investment costs.

Physical Ownership Without VAT

Although the platinum is physically stored outside the Netherlands, you remain the owner of the metal. You own physical platinum without the additional tax costs.

Flexibility

Within the bonded warehouse, you can easily sell your platinum without first having to import it into the Netherlands. This provides greater flexibility and simplicity in your investment strategy.

Purchase platinum for business

For businesses, it is important to know that platinum bars are sold with 21% VAT. However, business purchases of platinum can be advantageous since companies can account for VAT in their administration. When selling platinum bars, you can issue an invoice that includes 21% VAT, which can be reclaimed for tax purposes.

-nnx6DMxJ.png)