Why buy palladium?

More and more investors are choosing to buy palladium as an alternative to gold or silver. Palladium is a rare precious metal with unique properties and applications, especially in the automotive industry (catalytic converters), electronics and medical technology. As global demand continues to increase while supply is limited, palladium experiences strong price fluctuations.

More and more investors are choosing to buy palladium as an alternative to gold or silver. Palladium is a rare precious metal with unique properties and applications, especially in the automotive industry (catalytic converters), electronics and medical technology. As global demand continues to increase while supply is limited, palladium experiences strong price fluctuations.

Buying physical palladium: bars and coins

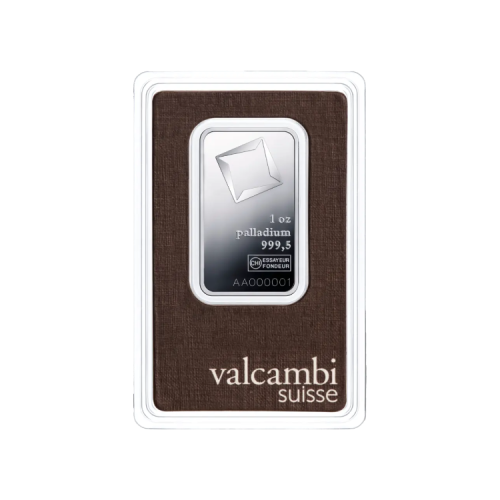

Our bars come with an official certificate of authenticity and meet the international standard of 999.5 pure palladium. The coins are struck by renowned mints and recognized worldwide. Both the bars and the coins have excellent marketability in the international precious metals market.

At The Silver Mountain, you can buy palladium in the form of:

- Palladium bars from recognized LBMA-accredited producers such as Valcambi.

- Palladium coins such as the Canadian Maple Leaf or American Eagle (if available)

Palladium coins are often in limited supply. Unlike palladium ingots, which we source directly from producers, palladium coins are usually sourced from private sellers through our purchasing organization Inkoop Edelmetaal.

VAT at palladium

Unlike gold, which is exempt from VAT, palladium - like platinum and silver - is considered a commodity for tax purposes. For this reason, the purchase of palladium is taxed at 21% VAT in most cases.

Unlike gold, which is exempt from VAT, palladium - like platinum and silver - is considered a commodity for tax purposes. For this reason, the purchase of palladium is taxed at 21% VAT in most cases.

However, there are exceptions. Palladium ingots purchased in conjunction with storage in a VAT-free vault are not subject to VAT. In addition, palladium coins from earlier vintages can be offered under the margin scheme, which means you do not pay 21% VAT. Newly minted coins, on the other hand, are taxed at 21% VAT by default.

Delivery or storage

You have several options after purchase at The Silver Mountain:

- Insured home delivery

- Pick up by appointment

- Professional storage via Edelmetaal Beheer Nederland

The Silver Mountain

Frequently asked questions about buying palladium

What determines the price of palladium?

The price of palladium is determined worldwide by supply and demand in the precious metals markets. A unique feature of palladium is its high dependence on a few mining countries, such as Russia and South Africa, which strongly influences its availability and price. Global automobile production also plays an important role: in fact, catalytic converters are the largest consumer of palladium. As a result, geopolitical or economic developments can have a big impact on the price.

When is a good time to buy palladium?

Palladium experiences significant price movements. For most investors, buy staggered over time and consider palladium as part of a broader portfolio of precious metals.

Why do I pay a higher premium on palladium than on gold?

The premium on palladium is higher because the metal is rarer, traded less frequently and has higher production and logistics costs. In addition, new palladium is taxed at 21% VAT, further driving up the price. There are also fewer suppliers operating in the market, which limits competition and price pressure.