Why buy gold?

In a world where financial markets are becoming increasingly volatile, inflation continues to rise and geopolitical tensions are running high, more and more people are returning to something old, something reliable: precious metals. Gold and silver in particular are gaining ground as an alternative to savings or shares. But why would you actually buy physical gold? And how does silver fit into that story?

In this article you can read all the advantages of gold and silver as a tangible, stable and globally tradable investment with practical tips and insights that are also interesting for novice investors.

Gold as a safe haven for your assets

Gold has always been a symbol of value and wealth throughout the ages. It was used as a currency, as a means of exchange and as a reserve by kings and later by central banks. Today, that function has not changed. Gold offers something that many modern financial products can no longer guarantee: security.

When you own physical gold, whether in the form of a gold coin, bar or a handy combi bar, you have tangible property. No paper promise, no digital investment, but real value in your own hands. And that gives peace of mind.

Inflation erodes your purchasing power, but gold protects

One of the main reasons why people buy gold is inflation. When prices rise and your savings become less and less valuable, gold proves to be a reliable buffer. Not because the value of gold itself increases, but because the value of money decreases.

The amount of gold in the world is limited. In contrast, central banks can print unlimited amounts of money. This automatically causes a depreciation of currencies such as the euro or the dollar, something that has become painfully apparent in recent years. In such a climate, gold flourishes as a 'store of value': a repository of purchasing power.

Central banks have known for a long time

That gold should be taken seriously is evident from the increasing purchases by central banks worldwide. Countries such as China, Russia, Turkey and India have significantly expanded their gold reserves in recent years. Why would they do that if gold were 'old-fashioned' or 'passé'?

The answer is simple: gold has no counterparty risk. It represents no debt, no promise. It is value. In a world where even government bonds are no longer considered risk-free, this is unique.

Gold is globally and directly tradable

Another major advantage is the liquidity of gold. You can sell a 1 troy ounce gold coin anywhere in the world or exchange it for money or goods. This makes gold a practical asset in times of crisis, when access to the financial system is not always self-evident.

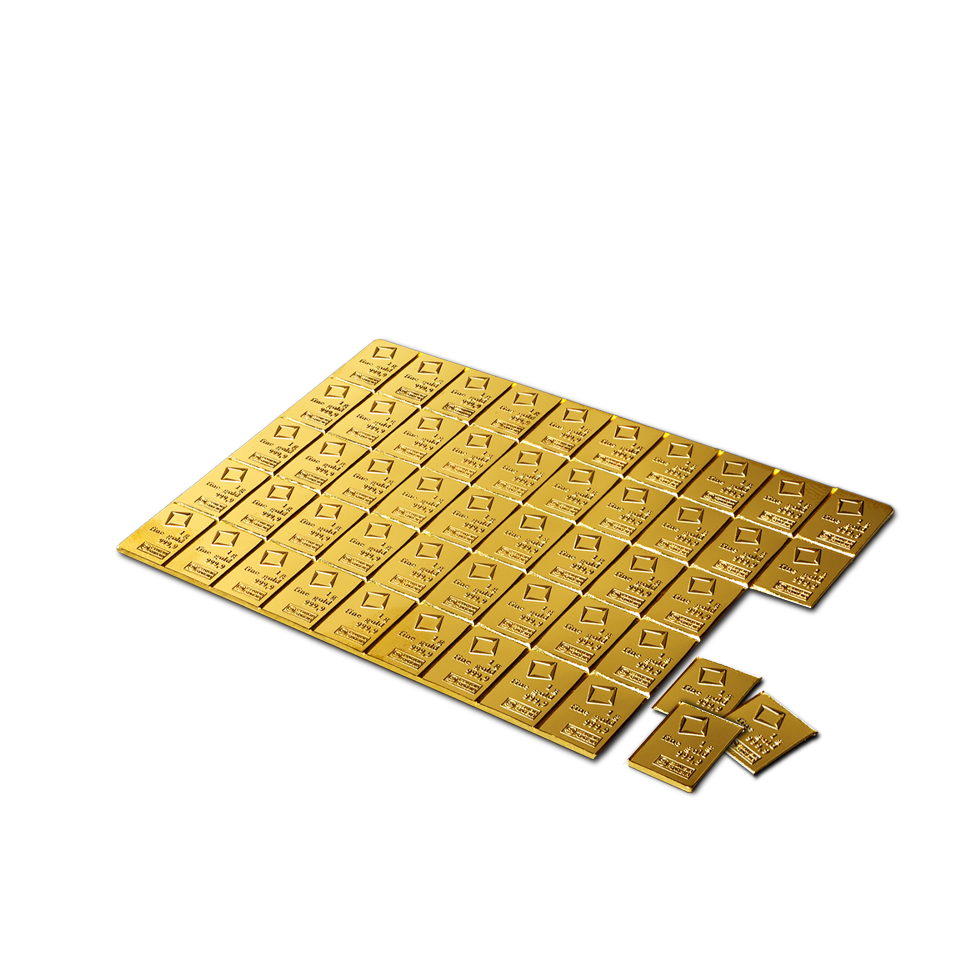

Some investors deliberately opt for a gold combi bar, which consists of small, degradable pieces of 1 gram. In theory, you can even make smaller payments with this, should it ever be necessary. It is not inconceivable that precious metal will once again be used as a means of exchange in times of extreme financial disruption.

At Inkoop Edelmetaal it is always possible to sell your precious metals, regardless of the volume and the price.

Silver also offers opportunities

Although gold is often in the spotlight, silver is at least as interesting. The precious metal is much cheaper per gram, which lowers the entry threshold. You can buy a silver coin for around €40. Moreover, silver is also an important industrial metal, indispensable in solar panels, batteries and electronics. As a result, demand is structurally increasing.

And then there is the so-called gold-silver ratio: a historical measuring instrument that shows how much silver is needed to buy one ounce of gold. This ratio suggests that silver is currently undervalued, which may offer additional price potential.

Low interest rates and failing trust in the system

Saving hardly yields anything anymore. In fact, in some cases you pay money to leave your money in the bank. At the same time, trust in governments, banks and financial institutions is waning. Think of frozen bank accounts, inflation above 5%, or wealth tax that disproportionately affects savers.

In this climate, people are looking for alternatives to savings, and physical gold or silver quickly come into the picture. You may not pay interest on it, but at least your wealth is not slowly being eaten away.

Long-term scarcity: “Peak Gold”

Gold is not infinitely available. Fewer and fewer large new gold veins are being discovered in mines worldwide, while demand is only increasing. Analysts even speak of 'Peak Gold': the moment when global production reaches its highest point and then structurally decreases.

According to a report by Goldman Sachs, the known underground gold reserves could be completely mined within twenty years. Less supply with increasing demand? That means pressure on the price and therefore possible returns for those who get in now.

Buying precious metals is not a hype, but a strategy

Buying gold and silver is not a speculation or a fad. It is a strategic choice to protect your assets against risks that you cannot control: inflation, system failure, geopolitics or tax burden. Physical precious metals form a kind of insurance against these uncertainties.

For those who want to spread and protect their assets, a portion in precious metals is virtually indispensable. Gold offers stability. Silver offers accessibility and growth potential.

Finally: start sensibly and get well informed

Whether you choose a 100 gram gold bar, a silver Maple Leaf or a 50 x 1 gram combi bar: make sure you buy from a reliable provider, pay attention to quality marks such as LBMA approval, and choose a storage form that suits you.

Buying gold is easy, but owning gold is strategic.

Daan Wesdorp is Purchasing Manager at Inkoop Edelmetaal, part of The Silver Mountain, and a specialist in trading physical precious metals. With a background in economics and years of experience in the financial markets, Daan possesses in-depth knowledge of stocks, cryptocurrencies, and precious metals. His broad market insight makes him a reliable source for investors looking to diversify and protect their assets. In his articles, Daan combines up-to-date market information with practical insights for both new and experienced investors.

About

About