-

Securily packaged

-

Buy back guarantee

-

Tradable world wide

-

Customer rating: 9.7

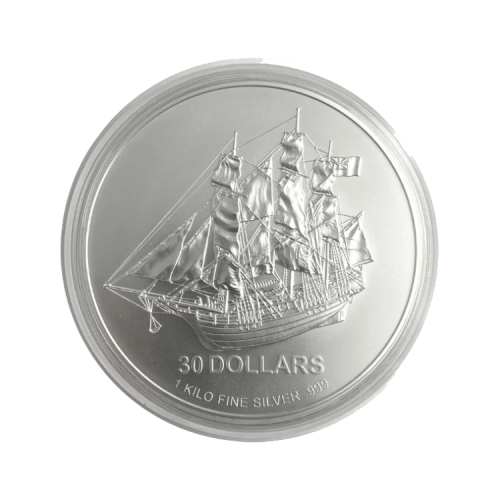

Each coin weighs 1 kilogram (1.000 grams) which is equal to 32 troy ounce. The coins are minted in 99.9% pure silver in Germany, by order of the government of Andorra. The coin has only been minted since 2008.

Specifications

Physical properties

Net weight

The net weight is determined by multiplying the gross weight with with the purity. |

1 kilo |

| Purity and metal type | 99,9% | Silver |

Origin

| Mint | Umicore |

Price properties

| Metal worth | € 2.085,37 |

Premium

The premium is determined by substracting the metal worth and possible taxes from the sales price. |

€ 505,63 |

| Selling price | € 2.591,00 |

Price per gram

The price per gram is determined by dividing the sales price by the net weight. |

€ 2,59 |

| Investment score | C-label |

| VAT-rate | Margin taxation |

Other specifications

| Buyback guarantee applicable | Yes - 110% |

| Pick up possible | Yes |

| Storage possible | Yes |

| Availability | In stock |

Price chart

The Belgian company Umicore specializes in various valuable materials, including gold and platinum. Additionally, Umicore is active with numerous other materials, such as technical compounds of cobalt, and even materials used for solar energy generation. Umicore has branches in the Netherlands (formerly Schone Edelmetaal), Belgium, and Germany, and is also active outside Europe in the mining, processing, and smelting of metals.

Investment score

Investment score

This product has a C-label (Collectibles). This means it is a less favorable investment choice compared to a product with a higher investment score. We consider products with a C-label to be collectibles. These are often coins minted in limited quantities, with luxury packaging and a unique theme.

Label informationAn A-label means that this is one of our most common products. When purchasing physical precious metals, we advise looking at both the lowest price per gram and the lowest spread. The spread indicates the difference between the buying and selling price. An A-label signifies that this is a favorable choice when buying gold and silver.

B-label means that this is a common coin or bar, which is widely tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice.

C-label means that this is a less favorable investment choice compared to a product with a higher investment score. Products with a C-label are considered collectibles.

Price alert

Price alert

Delivery service - From 11 March delivered

Delivery service - From 11 March delivered