-

Securily packaged

-

Buy back guarantee

-

Tradable world wide

-

Customer rating: 9.7

1 kilo silver bar coins are an alternative for regular silver bars. Due to the fact there is a coin minted in this bar, the bar is a legal tender coin at the Cook Islands. Cook Islands kilo bar coins are the ideal alternative for more expensive regular silver bars.

Specifications

Physical properties

Net weight

The net weight is determined by multiplying the gross weight with with the purity. |

1 kilo |

| Purity and metal type | 99,99% | Silver |

Origin

| Meltery | New Zealand Mint |

Price properties

| Metal worth | € 3.079,39 |

Premium

The premium is determined by substracting the metal worth and possible taxes from the sales price. |

€ 742,61 |

| Selling price | € 3.822,00 |

Price per gram

The price per gram is determined by dividing the sales price by the net weight. |

€ 3,82 |

| Investment score | B-label |

| VAT-rate | Margin taxation |

Information

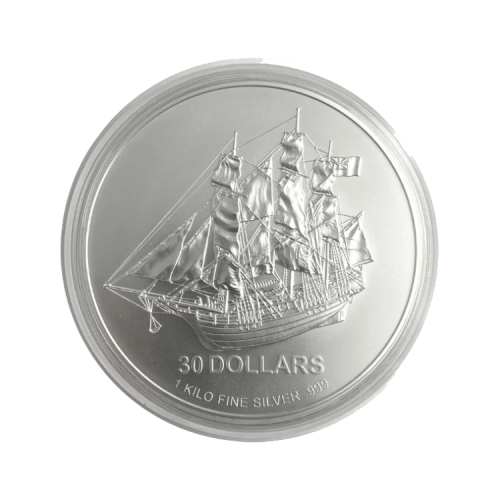

1 kilo Cook Islands Bounty silverbar

The 1 Kilo Cook Islands Bounty silver mint bar is a popular choice among investors and collectors alike. Weighing 1 kilogram, it is made from 99.9% pure silver. The bar is issued by the Perth Mint in Australia and minted by Heimerle + Meule, a precious metals producer from Germany.

The obverse of the bar features an image of the Bounty ship, a historic vessel that sank in 1789. The year of issue, weight, and purity of the bar are also displayed on the obverse. On the reverse side, there is a portrait of Queen Elizabeth II.

The fact that the bar is VAT-free in the Netherlands makes it an even more attractive choice.

Price chart

Investment score

Investment score

This product has a B-label (Common bullion coins and bars). This means that it is a common coin or bar that is easily tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice. Examples of coins with a B-label are coins with a lower mintage.

Label informationAn A-label means that this is one of our most common products. When purchasing physical precious metals, we advise looking at both the lowest price per gram and the lowest spread. The spread indicates the difference between the buying and selling price. An A-label signifies that this is a favorable choice when buying gold and silver.

B-label means that this is a common coin or bar, which is widely tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice.

C-label means that this is a less favorable investment choice compared to a product with a higher investment score. Products with a C-label are considered collectibles.

-AA58UPFC-web_normal.png)