What are the Dutch VAT rules for platinum coins?

Update: 29 July 2025 Reading time: 4 min

Gold is primarily an investment product and therefore exempt from VAT in the Netherlands. For silver and platinum, the rules are a bit more complex. In this article, we explain how Dutch VAT applies to platinum.

Between silver and gold

Gold, as mentioned above, is primarily an investment product. Although it is also used in industry, for example in smartphones, gold is mainly popular in jewelry or as an investment in the form of physical gold or through trading in gold via shares. Silver is, much more than gold, an industrial commodity with applications in the medical industry, solar panels, mirrors, and electronics.

For that reason, different VAT rules apply to silver than to gold. Platinum sits somewhat between gold and silver: more than gold, it is an industrial commodity, primarily used for catalytic converters in cars, but increasingly popular in China as a material for jewelry, more exclusive than silver, but more affordable than gold.

Growing popularity

For several years, platinum was less popular as an investment. This was mainly due to the energy transition in the automotive industry. As a result, less platinum was expected to be needed, which kept industrial demand low compared to supply, and prices were relatively low for several years.

However, the energy transition is progressing more slowly than expected, and platinum production has structurally declined due to market conditions and, for example, flooding in South Africa. Combine that with increased demand for platinum jewelry from China, and the market balance has shifted, with relatively high demand and low supply expected in the coming years. This makes platinum an interesting and potentially undervalued investment.

Same VAT rules as silver

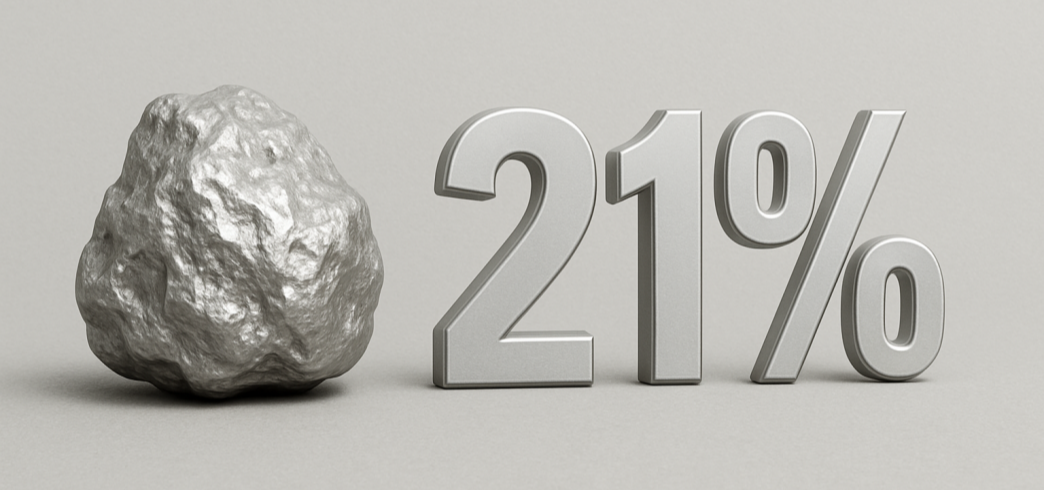

Despite platinum’s growing popularity, it does not have the same status as gold, and therefore the same VAT rules apply as for silver. This means that platinum bars, like silver, are subject to 21% VAT.

For coins, there was an exception up until 2025, allowing them to be traded under the margin scheme. In practice, this meant VAT only had to be paid on the dealer’s profit margin, not on the full value of the coin. Unfortunately, this scheme has been discontinued, although it still applies to platinum and silver coins minted before 2025. As a result, there is now high demand for those older coins, while new coins remain relatively expensive.

How does VAT apply to platinum?

For clarity, here is a summary of the rules:

-

Platinum bars – Subject to 21% VAT, with no distinction between old and new bars

-

Platinum coins minted before 2025 – Subject to the margin scheme, 21% VAT on the dealer’s margin

-

Platinum coins minted in 2025 or later – Subject to 21% VAT

Is VAT on platinum coins a problem?

Naturally, the new VAT rules for platinum are not ideal. Just like with silver, VAT is an additional cost compared to gold, making gold a more attractive option. This is despite the fact that platinum and silver may offer more growth potential—especially with gold prices currently at high levels. In fact, the high gold price is one reason jewelry makers are looking for alternatives. Portfolio diversification can also support a sound investment strategy, but the VAT policy makes this less appealing.

It’s definitely worth considering so-called pre-owned platinum coins, as these are not subject to VAT—but demand for these coins is high. Whether you’re willing to accept the 21% surcharge for new coins is a decision you’ll need to make for yourself.

Interested in platinum coins or bars? Check the current stock here.

Disclaimer: The Silver Mountain does not provide investment advice and this article should not be considered as such. Past performance is no guarantee of future results.

Over Sander Cox

Over Sander Cox

Marketeer

-(1)-5jtGeett-web_normal.png)