About our 1 gram gold bars

Buying a 1 gram gold bar is the most accessible way to purchase physical gold. Its compact size means that the entry price is low, making this product attractive to investors who want to invest in gold in a safe and gradual manner. Each 1 gram gold bar is produced with a purity of 99.99% gold (24 carat) and is recognized worldwide by traders, banks, and exchanges.

An important advantage of this small size is maximum flexibility. While larger gold bars are mainly interesting for long-term investments involving large amounts, a 1-gram gold bar offers the possibility to buy or sell in small quantities. This makes it an option for those who see gold primarily as a means of storing value in a flexible and tangible way.

Advantages of small gold bars

Advantages

- Low entry price: due to their low weight, 1 gram gold bars are affordable for a wide range of investors.

- Flexibility: the small size makes it easy to sell gold in parts.

- Diversification: you can purchase gold step by step and thus spread your investment over time.

Disadvantages

- Higher premium per gram: the production costs of a 1-gram gold bar are relatively high, making the price per gram more expensive than larger gold bars.

- Less efficient for large amounts: those who want to invest larger sums in gold directly often opt for gold bars of 50 grams, 100 grams, or more.

Buying a 1-gram gold bar is therefore mainly a choice for investors who value flexibility, while efficiency is less of a priority for larger amounts.

How does the gold price come about?

When you compare buying a 1 gram gold bar with larger denominations, you will see clear differences.

- Price per gram: the larger the gold bar, the lower the premium per gram. With a 100 gram gold bar, you often pay only a fraction of the premium that a 1 gram gold bar has.

- Storage: larger gold bars take up less space and are more practical to store safely.

- Liquidity: small gold bars are easier to trade in parts, while a large gold bar must be sold in one go.

However, for investors who value flexibility over efficiency, buying a 1 gram gold bar may be preferable.

Buy multiple 1 gram gold bars

Gold combi bars

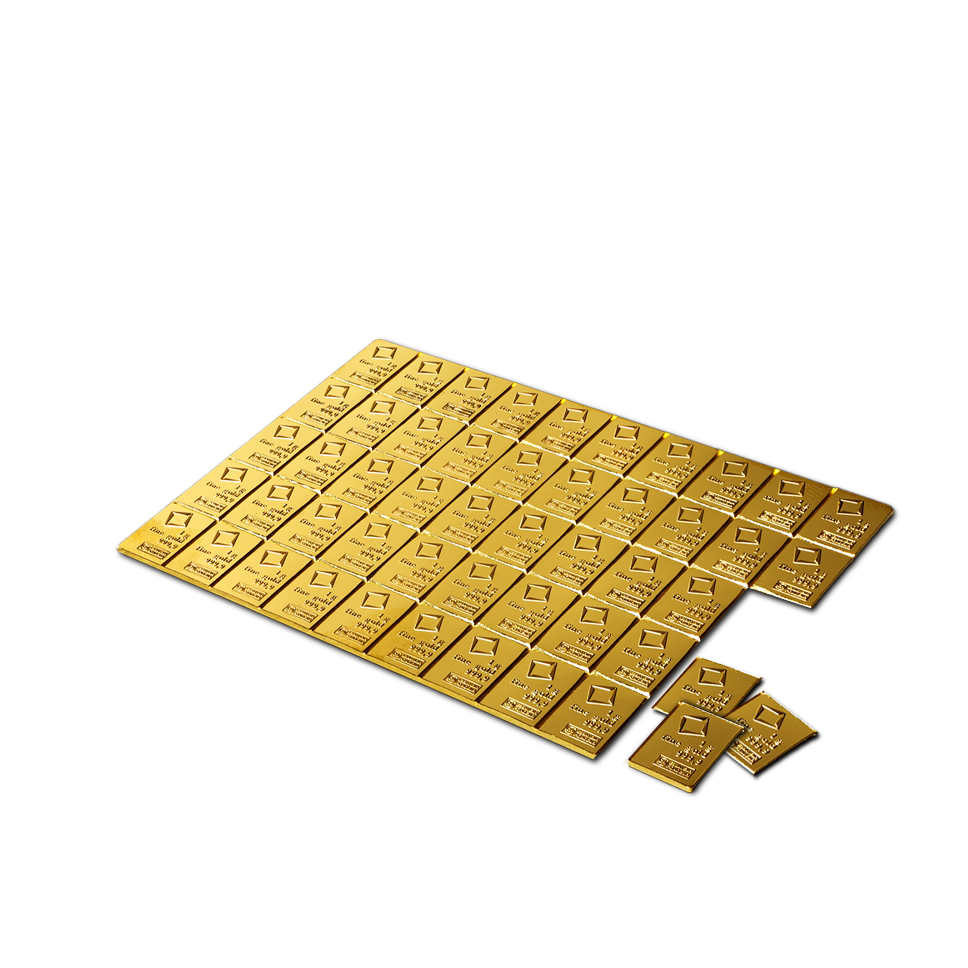

An interesting alternative to individual 1-gram gold bars is the gold combi bar. This is a larger gold bar, often 50 grams or 100 grams, which is made up of 1-gram segments.

These denominations are easy to break off, combining the flexibility of small denominations with the lower premium of a larger gold bar. For those considering buying 1 gram gold bars but also wanting to save on costs, the combibar is a logical choice.

5 or 10 gram gold bars

For those who want to invest a larger amount but do not want to completely give up the flexibility of small denominations, 5 gram or 10 gram gold bars may be of interest. These offer a better price per gram and are still easy to handle.

Gold coins

Gold coins are also a flexible alternative. Popular investment coins such as the Maple Leaf or the Krugerrand are tradable worldwide, often have a low weight (1 troy ounce or less) and are available in many denominations.

Buy-back guarantee for gold bars 1 gram

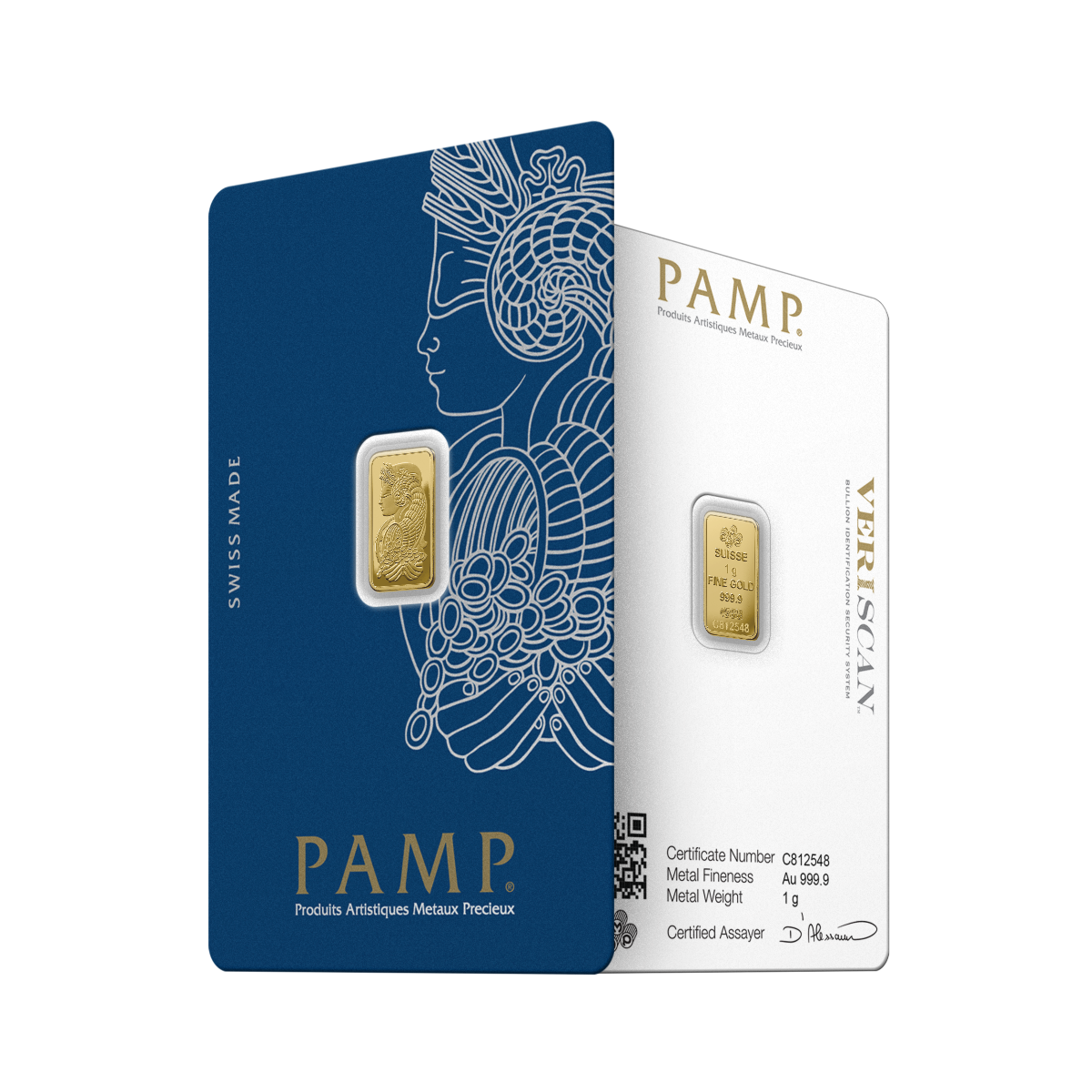

https://www.thesilvermountain.nl/goud-kopen/goudbaren/umicore-barenEvery 1 gram gold bar you purchase is manufactured with a purity of 99.99% pure gold (24 carat). Most gold bars feature:

- LBMA accreditation: this hallmark from the London Bullion Market Association guarantees that the gold bars are tradable worldwide.

- Certificate of authenticity: this states the weight, purity, and serial number.

- Sealed packaging: many manufacturers supply gold bars in a so-called assay card, which guarantees authenticity and protection.

Well-known manufacturers of 1 gram gold bars include Umicore, Valcambi, Heraeus, and PAMP Suisse.

Marketability and liquidity

Buying a 1 gram gold bar also means investing in a product that is easily tradable worldwide. Due to its small denomination, an investor can easily sell part of their holdings without immediately drawing on larger capital.

This makes the 1 gram gold bar particularly suitable in situations where flexibility is important, such as:

- spreading sales over time,

- maintaining access to small amounts of physical gold, or building up a stockpile in small steps.

Practical tips for buying 1 gram gold bars

Anyone considering purchasing a 1-gram gold bar would be wise to consider the following points:

- Choose recognized suppliers: always buy from a dealer that offers LBMA-accredited gold bars.

- Storage: decide in advance whether you want to store the gold bars at home, in a safe, or externally with a provider.

- Spread: consider spreading your purchases over several moments to spread price fluctuations in the gold price.

Is a 1 gram gold bar suitable for you?

Buying a 1 gram gold bar is particularly interesting for investors who are looking for maximum flexibility and want to invest in physical gold in small increments. The product is recognized worldwide, highly liquid, and easy to trade. On the other hand, the premium per gram is relatively high compared to larger gold bars.

For those who prioritize efficiency and lower costs, a larger gold bar may be more attractive. Those who want to combine flexibility with lower premiums will find the gold combibar an excellent alternative.

By taking these considerations into account, you can easily determine whether a 1 gram gold bar is the right choice for your investment strategy.

Selling 1 gram gold bars

It is also possible to sell your gold bars through Inkoop Edelmetaal. We offer a fixed percentage of the current gold price for your gold bars.

Frequently asked questions about 1 gram gold bars

Why buy 1 gram of gold?

Besides being easy to sell, this 1 gram gold bar also has the lowest entry price if you want to start investing in gold. In addition, all our 1 gram gold bars come from recognised producers and the 1 gram gold bars come with a certificate of authenticity. As the 1 gram gold bars are small in size, you can easily keep them safe. Would you like to know more about buying gold? Then read our extensive articles on buying gold.

Is the 1 gram the smallest gold bar there is?

Yes. A 1 gram gold bar is the smallest gold bar available commercially. Both well-known producers like Umicore and Pamp Suisse, as well as smaller producers issue 1 gram gold bars.

Which 1 gram gold bars are on sale?

There are several 1 gram gold bars for sale from various producers. Popular LBMA-accredited producers include Umicore, C. Hafner, Pamp Suisse and Britannia gold bars. All these gold bars are minted in 99.99% pure gold.