-

Securily packaged

-

Buy back guarantee

-

Tradable world wide

-

Customer rating: 9.7

The American Gold Eagle coin contains exactly 1 troy ounce of pure gold and is made of 22-karat gold, meaning the coin contains an alloy of gold, silver, and copper for added durability. This iconic gold coin was introduced in 1986 by the United States Mint and has since become one of the most popular investment coins in the world.

Specifications

Physical properties

Net weight

The net weight is determined by multiplying the gross weight with with the purity. |

1 troy ounce |

| Purity and metal type | 91,67% | Gold |

| Gross weight | 33,93 gram |

| Dimensions | 40.6 x 2.98 mm |

| Condition |

Good condition

In good condition with possible superficial scratches or stains, without affecting the value or buyback guarantee. |

Origin

| Country of origin | United States |

| Mint | US Mint |

| Year of issue | Mixed years |

| Face Value | 50 dollars |

Price properties

| Selling price | € 4.414,00 |

| Metal worth | € 4.258,54 |

Price per gram

The price per gram is determined by dividing the sales price by the net weight. |

€ 141,92 |

Premium

The premium is determined by substracting the metal worth and possible taxes from the sales price. |

€ 155,46 |

| Investment score | A-label |

| VAT-rate | Investment gold |

Other specifications

| Pick up possible | Yes |

| Storage possible | Yes |

| Availability | Delivery time: 1 - 2 weeks |

Information

1 troy ounce American gold Eagle

The Gold Eagle, like its silver variant, the Silver Eagle, has been issued by the United States Mint since 1986. This iconic coin contains exactly 1 troy ounce of pure gold and is struck in 22-carat gold. Due to the alloy with silver and copper, the coin weighs slightly more than most other gold investment coins, namely 33.93 grams. The American Gold Eagle is the first investment coin from the United States that is specifically designed to be traded based on its gold value.

Why choose American Eagle previous years?

Gold American Eagles from previous years are priced more competitively than coins purchased directly from the mint. This results in a smaller spread: the difference between the sales price and the current gold price.

Previous years of the gold American Eagle

The gold American Eagles that we offer come from various previous years and are purchased from private individuals. Between 1986 and 2020, the design of the coins remained unchanged, but in 2021 the United States Mint introduced a new and refined design. We supply various years, it is not known in advance which year and design you will receive.

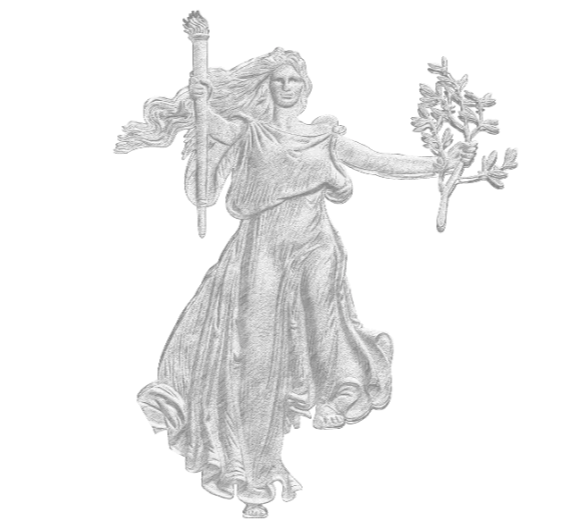

Design gold American Eagle coin

Obverse

The obverse of the American Eagle gold coins features an image of Lady Liberty, based on the iconic design of the historic Saint-Gaudens gold coins. Lady Liberty is depicted holding a torch in her right hand and an olive branch in her left hand, symbolizing freedom and peace.

Reverse

The reverse of the coin features a majestic eagle, a powerful symbol of the United States. This design emphasizes the national pride and strength of America, as often seen on American coins. Additionally, the reverse features the inscriptions: United States of America, 1 oz fine gold and 50 dollars, indicating the coin’s weight, purity and face value.

Gold American Eagle coins as investments

Gold Eagle coins, like the other gold coins of 1 troy ounce of gold that we trade, are well known and therefore easily tradable worldwide. No certificate of authenticity is issued for these types of coins. The United States Mint guarantees the authenticity of the coins and is a mint that is legally required by the government in America to meet the demand for gold and silver coins by minting enough coins.

Featured on the American Gold Eagle

- Minted in 22 carat and weighing 33.93 grams, it contains exactly 31.103 grams of pure gold

- Coin that is easily tradable worldwide

- Buyback guarantee

The images shown are indicative. We supply coins of various vintages.

Price chart

US Mint

The United States Mint is the official mint of the United States. Established in 1792 through the Coinage Act of 1792, this mint produces the Silver Eagle, Gold Eagle, and other investment coins.

Investment score

Investment score

This product has an A-label (Our top 100 products). This means that it is one of our most common products. When purchasing physical precious metals, we recommend looking at both the lowest price per gram and the lowest spread. The spread indicates the difference between the buying and selling price. An A-label means this is a favorable choice when buying gold and silver.

Label informationAn A-label means that this is one of our most common products. When purchasing physical precious metals, we advise looking at both the lowest price per gram and the lowest spread. The spread indicates the difference between the buying and selling price. An A-label signifies that this is a favorable choice when buying gold and silver.

B-label means that this is a common coin or bar, which is widely tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice.

C-label means that this is a less favorable investment choice compared to a product with a higher investment score. Products with a C-label are considered collectibles.

Price alert

Price alert