Is buying gold a good idea?

Gold has been considered a safe haven for thousands of years. But is buying gold anno today still wise? In this article, we analyze the pros and cons of investing in gold based on facts, statistics and economic insights. We also discuss when it is or is not smart to buy gold.

Where to buy gold?

At The Silver Mountain, you buy and sell physical gold and silver. All our products come from recognized mints or producers and are therefore tradable worldwide. We have AFM-licensed storage facilities and offer you the opportunity to sell your bullion back to us at any time, under fair and transparent conditions.

What makes gold valuable?

Scarcity and physical properties

Gold is a rare precious metal that does not naturally oxidize or corrode. As a result, it retains its luster and quality even after centuries. These unique properties, combined with its worldwide acceptance as a means of payment and store of value, make gold a reliable asset protection tool.

The total above-ground gold reserves are estimated to be around 216,000 tons. Most of it is incorporated into jewelry, held by central banks as a strategic reserve, or used for investment in the form of coins and bars.

Historical value stability

Unlike fiat money (such as the euro or dollar) that is subject to inflation, gold retains its purchasing power over the long term. A well-known example: in Roman times, one troy ounce of gold could buy a toga, today for that same ounce you can buy a high-quality custom-made suit. Gold is therefore a proven stable investment.

Unlike fiat money (such as the euro or dollar) that is subject to inflation, gold retains its purchasing power over the long term. A well-known example: in Roman times, one troy ounce of gold could buy a toga, today for that same ounce you can buy a high-quality custom-made suit. Gold is therefore a proven stable investment.

Advantages of buying gold

1. Protection against inflation

Gold has historically been a good hedge against inflation. When the value of money falls, the price of gold often rises along with it. Examples are the 1970s and the period after the 2008 financial crisis.

📈 Are you considering purchasing gold as a hedge against inflation? Discover our current range of gold bars and gold coins.

2. Safe in the event of geopolitical turmoil

Gold has been considered a safe haven in times of uncertainty for centuries. During wars, political tensions and economic crises, demand rises, driving up the price. In 2020, gold prices peaked above $2,000 per troy ounce during the COVID-19 pandemic. Since then, conflicts such as the war in Ukraine and ongoing tensions in the Middle East have further enhanced that role of gold. Thus, today the gold price stands at nearly $3,350 per troy ounce, a historic high that underscores confidence in gold as a store of value.

Quenstion about buying gold?

Do you have questions about buying gold? If so, please feel free to contact one of our experts. Would you prefer an exploratory meeting, by phone or at our office? That is also possible. We are at your service and are happy to share our knowledge so you can make an informed decision.

3. No counterparty risk

Physical gold has no credit risk. Unlike financial products such as stocks or bonds, with physical gold you are not dependent on a financial institution.

🔐 At The Silver Mountain, you buy physical gold that is tradable worldwide thanks to LBMA Good Delivery accreditation. Our gold bars are available directly from stock and can be safely stored in allocated storage facilities if required.

4. Global liquidity

Gold is recognized and traded all over the world. In virtually every economy, you can redeem physical gold at the current spot price.

Sell gold

Do you want to sell your gold? We buy your gold directly at a transparent bid price based on the current gold price.

Disadvantages of buying gold

1. No interest or dividends

Unlike stocks, bonds or real estate, gold does not generate passive income. The only gain comes from any appreciation in value.

2. Short-term price volatility.

Although gold is relatively stable over the long term, its price can fluctuate in the short term. This makes it less suitable for short-term speculative positions.

3. Storage and insurance costs.

Physical gold must be stored securely. This usually involves costs for a vault, insurance or external storage.

🏦 Don't have a secure storage location? Take advantage of our allocated storage, where your gold is individually allocated, insured and immediately deliverable.

What is a good time to buy gold?

✔ During economic uncertainty

Gold offers protection during uncertainty about interest rate policy, currency turmoil or banking instability.

✔ For diversification of your portfolio.

Gold has a low correlation with other asset classes. Investing a portion of your assets in gold (5% to 15%) lowers your overall portfolio risk.

✔ As long-term protection

Physical gold acts as insurance against systemic risks such as hyperinflation, banking crises and geopolitical turmoil.

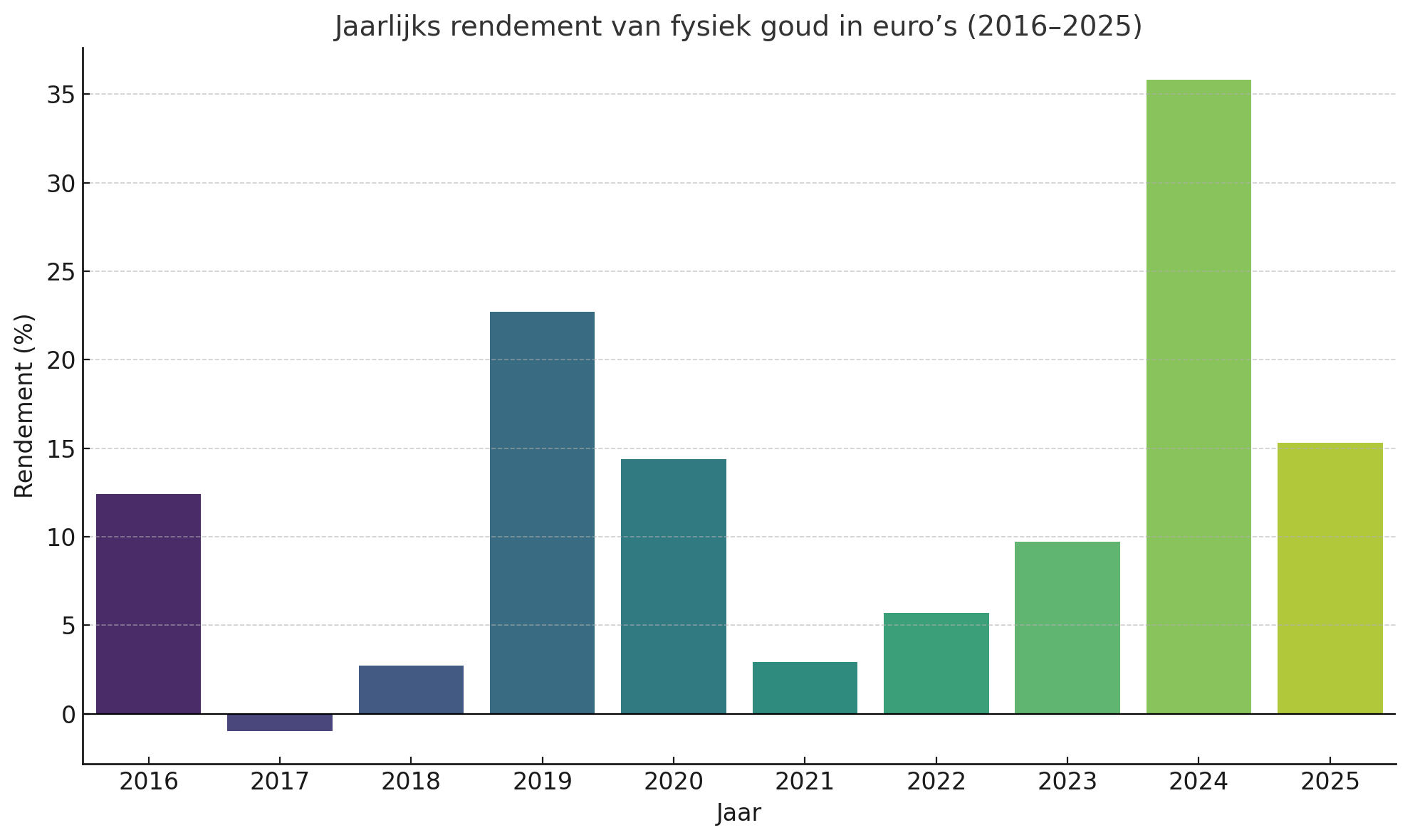

Return on gold by year

Physical gold has performed remarkably well in recent years. Although returns can fluctuate from year to year, the long-term trend shows a clear positive picture:

The chart shows gold yielding a predominantly positive return, with only one slightly negative year (2017: -1.0%). Outliers include:

- 2019: +22.7%

- 2020: +14.4% (COVID-19 pandemic)

- 2024: +35.8% (record year)

- 2025: +15.3% (preliminary, through June 21)

On average, returns over this period come in at about 13% per year, showing gold to be a stable and worthwhile investment, especially in times of economic or geopolitical uncertainty.

When is buying gold less wise?

✘ When interest rates are rising sharply

When interest rates are high, gold becomes relatively less attractive because it does not generate interest.

✘ If you expect quick returns

Gold is primarily a long-term investment. Investors looking for short-term gains are better off considering other instruments.

✘ Without sufficient preparation

Purchasing gold without knowledge of authenticity, market opportunities or storage options can lead to unnecessary risks.

In doubt about the right form or quantity of gold? Our specialists will be happy to help you by looking at your situation and requirements with you. Please feel free to contact us.

Conclusion: is buying gold wise?

Buying gold can certainly be wise, depending on your financial goals. The precious metal is not a tool for quick profit, but rather a value-proof buffer within a balanced wealth structure.

Those who use gold for protection against inflation, geopolitical risks or as part of a diversified portfolio are choosing stability and resilience. In that context, gold contributes to what matters to many investors: a secure future at their fingertips.

As with any investment, it is important to align gold's role with your overall financial planning.

Frequently Asked Questions

Which is wiser: saving or buying gold?

Savings currently yield little interest. With inflation, your savings lose value, while gold retains purchasing power better.

Is physical gold safer than gold ETFs?

Physical gold is tangible, globally tradable and free of counterparty risk. ETFs are easier to trade, but are paper products with potential underlying risks.

When is the right time to buy gold?

Timing is tricky. Therefore, many investors choose staggered purchases over time (cost averaging) to reduce the risk of getting in once.

Disclaimer: The Silver Mountain does not provide investment advice and this article should not be considered as such. Past results provide no guarantees for the future.

Daan Wesdorp is Purchasing Manager at Inkoop Edelmetaal, part of The Silver Mountain, and a specialist in trading physical precious metals. With a background in economics and years of experience in the financial markets, Daan possesses in-depth knowledge of stocks, cryptocurrencies, and precious metals. His broad market insight makes him a reliable source for investors looking to diversify and protect their assets. In his articles, Daan combines up-to-date market information with practical insights for both new and experienced investors.

About

About