-

Securily packaged

-

Buy back guarantee

-

Tradable world wide

-

Customer rating: 9.7

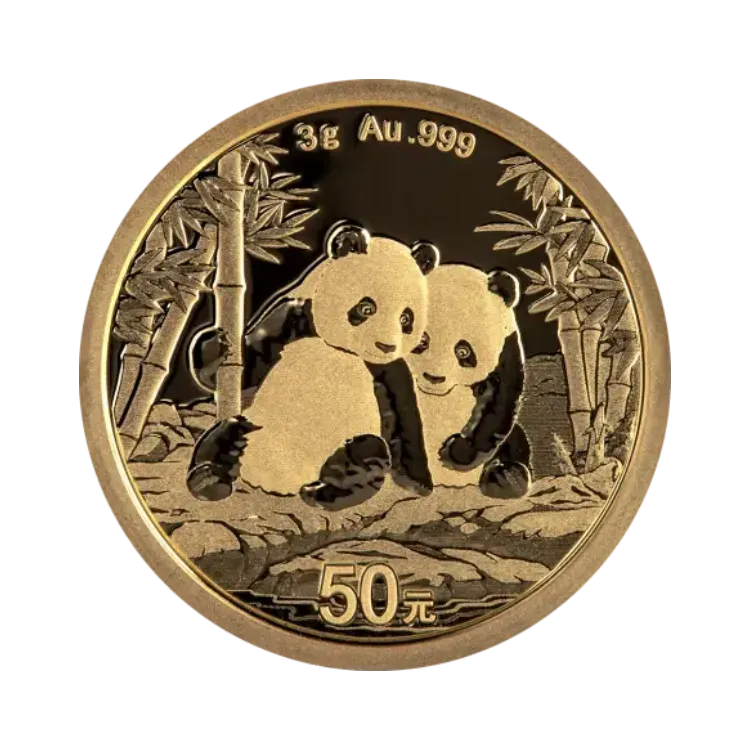

The 3 gram China Panda gold coin 2026 is an official investor coin from China, minted in 99.9% pure gold (Au .999) with a face value of 50 Yuan. Thanks to its compact weight and annually changing panda motif, this coin is a flexible choice for those who want to invest in gold in smaller denominations and appreciate a light collector's value.

Specifications

Physical properties

Net weight

The net weight is determined by multiplying the gross weight with with the purity. |

3 gram |

| Purity and metal type | 99,9% | Gold |

| Condition |

Brilliant uncirculated

These coins are newly minted and have never been in circulation. We deliver these in the original packaging. |

Origin

| Country of origin | China |

| Mint | China Gold Coin Corp. |

| Year of issue | 2026 |

Price properties

| Selling price | € 514,00 |

| Metal worth | € 405,53 |

Price per gram

The price per gram is determined by dividing the sales price by the net weight. |

€ 171,33 |

Premium

The premium is determined by substracting the metal worth and possible taxes from the sales price. |

€ 108,47 |

| Investment score | B-label |

Other specifications

| Storage possible | Yes |

| Availability | In stock |

Information

Buy the gold Panda coin 2026

The 3-gram gold Panda coin 2026 is ideal for those who want to invest in smaller denominations of gold. With 3 grams of pure gold per coin, the purchase price remains reasonable, while you still add a tangible amount of precious metal to your portfolio. This size offers flexibility: in the future, you can easily sell, exchange, or gift part of your position without immediately parting with a large coin.

Small denomination, great flexibility

Investing in small denominations of gold gives you more control over the timing and size of transactions. The 3g Panda is perfect for this:

- easy to stack in multiple pieces per year,

- easy to combine with 1g, 8g, 15g, and 30g Panda coins,

- practical for phased accumulation or reduction of your gold position.

This allows you to steadily build up a position in physical gold, spread across multiple coins and years.

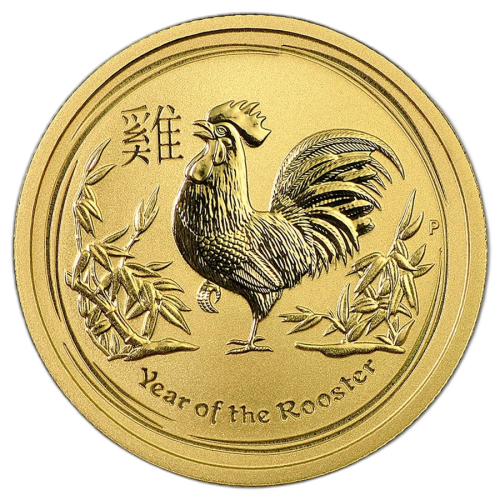

Collectible bullion with a new design every year

The Panda series clearly falls into the collectible bullion category: investment coins with a serious gold value, but also with a small collectible aspect. Each year, a new, unique panda motif is released, making it simply fun to save the series.

In addition, the premium generally remains lower than for genuine collector or proof coins. So you mainly pay for the gold and the craftsmanship, not for artificial scarcity.

Price chart

China Gold Coin Corp.

The China Gold Coin Corporation is the official mint of China and the only institution that deals in Chinese gold and silver coins. The China Gold Coin Corporation aims to design, manufacture, and market Chinese collectible and investment coins. The primary motif chosen is the protected panda bear, which is not only a national symbol but also the oldest ambassador of the Republic of China. The beautiful, high-quality coins are sought after worldwide, making China Gold Coin Corporation a global player in the market.

Investment score

Investment score

This product has a B-label (Common bullion coins and bars). This means that it is a common coin or bar that is easily tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice. Examples of coins with a B-label are coins with a lower mintage.

Label informationAn A-label means that this is one of our most common products. When purchasing physical precious metals, we advise looking at both the lowest price per gram and the lowest spread. The spread indicates the difference between the buying and selling price. An A-label signifies that this is a favorable choice when buying gold and silver.

B-label means that this is a common coin or bar, which is widely tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice.

C-label means that this is a less favorable investment choice compared to a product with a higher investment score. Products with a C-label are considered collectibles.

Price alert

Price alert

Delivery service - From 13 March delivered

Delivery service - From 13 March delivered

-2zqAcZYR-web_normal.png)