-

Securily packaged

-

Buy back guarantee

-

Tradable world wide

-

Customer rating: 9.7

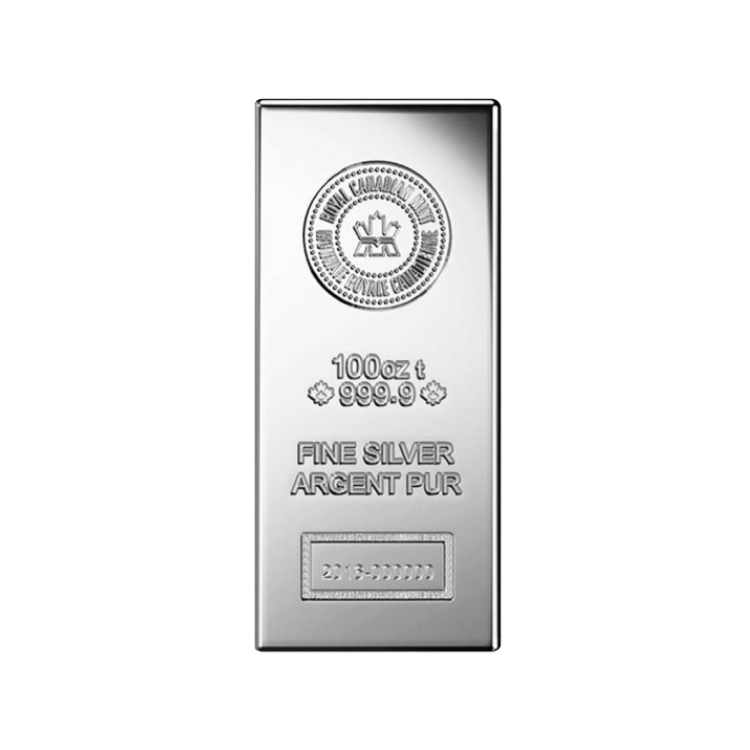

The 100 troy ounce silver bar comes from an LBMA Good Delivery refinery and guarantees a high-quality, globally tradable investment product. This large silver bar, weighing over 3.1 kilograms of pure silver, offers investors an efficient way to add physical silver to their portfolio at a low premium. We supply this 100 troy ounce silver bar from various manufacturers, so the image is for illustrative purposes only.

Specifications

Physical properties

Net weight

The net weight is determined by multiplying the gross weight with with the purity. |

100 troy ounce |

| Purity and metal type | 99,9% | Silver |

| Condition |

As good as new

In good condition with possible superficial scratches or stains, without affecting the value or buyback guarantee. |

Origin

| Meltery | Divers |

| Good Delivery Status | Yes |

Price properties

| Metal worth | € 8.769,95 |

Premium

The premium is determined by substracting the metal worth and possible taxes from the sales price. |

€ 626,75 |

| VAT | € 1.973,31 |

| Selling price | € 11.370,00 (€ 9.396,69 excluding VAT) |

Price per gram

The price per gram is determined by dividing the sales price by the net weight. |

€ 3,66 |

| Investment score | B-label |

| VAT-rate | Taxable Goods |

Information

Buy 100 troy ounce silver bars

The 100 troy ounce silver bar is one of the most recognizable and trusted forms of physical silver. Weighing over 3.1 kilograms of pure silver, this bar is an attractive choice for investors who want to purchase larger quantities of silver at a competitive premium.

All silver bars of this size come from an LBMA Good Delivery refinery, which means they meet the highest international quality and purity standards. This guarantees a purity of at least 99.9% silver and makes the bars easily tradable worldwide at banks, dealers, and exchanges.

Features of the 100 troy ounce silver bar

- Weight: 100 troy ounces (≈ 3.11 kilograms)

- Purity: 99.9% pure silver

- Origin: LBMA Good Delivery refinery

- Globally recognized and easily tradable

- Low premium compared to the silver price

VAT on silver bars

Unlike gold, which is exempt from VAT in Europe as an investment product, silver bars are subject to the high VAT rate of 21%. This is because silver is also an essential industrial raw material worldwide. For private investors, there are often more advantageous alternatives, such as silver coins or silver coin bars. These products are exempt from VAT, allowing you to invest in physical silver without paying additional tax. Another option is storage in our secure vaults in Zurich, where silver can be stored VAT-free.

For business customers, on the other hand, VAT on silver bars can usually be reclaimed. This makes the purchase of large bars, such as the 100 troy ounce, particularly interesting. Because the premium per gram is considerably lower for bars than for coins, this format is an efficient and cost-effective way for companies to invest in silver.

All prices we show for silver bars include VAT (where applicable), so you have immediate insight into the total costs.

Price chart

Investment score

Investment score

This product has a B-label (Common bullion coins and bars). This means that it is a common coin or bar that is easily tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice. Examples of coins with a B-label are coins with a lower mintage.

Label informationAn A-label means that this is one of our most common products. When purchasing physical precious metals, we advise looking at both the lowest price per gram and the lowest spread. The spread indicates the difference between the buying and selling price. An A-label signifies that this is a favorable choice when buying gold and silver.

B-label means that this is a common coin or bar, which is widely tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice.

C-label means that this is a less favorable investment choice compared to a product with a higher investment score. Products with a C-label are considered collectibles.

Price alert

Price alert