-

Securily packaged

-

Buy back guarantee

-

Tradable world wide

-

Customer rating: 9.7

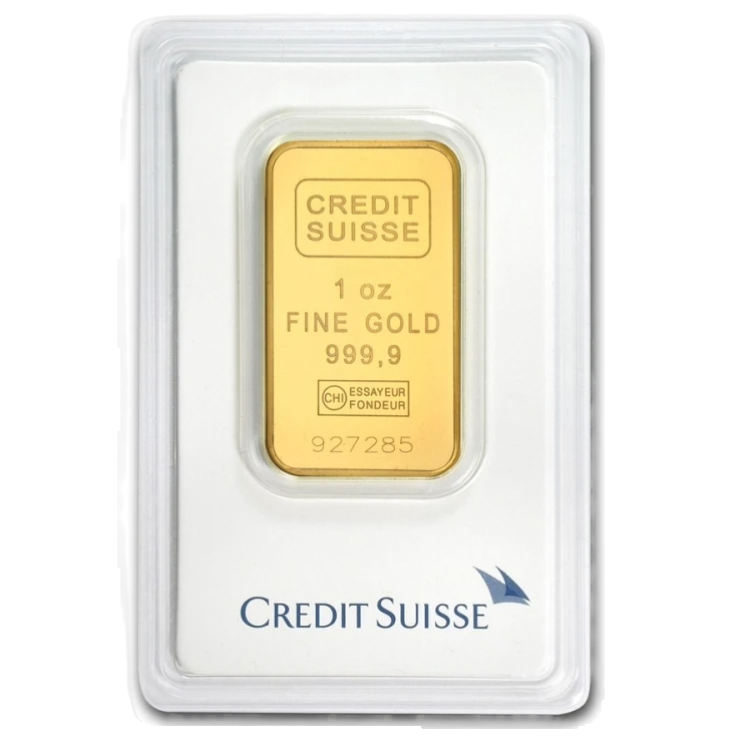

Credit Suisse gold bars contain 1 troy ounce (31.103 grams) of pure gold (99.99%). These gold bars are sealed in a certificate of authenticity. Credit Suisse is an LBMA Good Delivery refinery of gold bars. These bars are tradable without further analysis and are guaranteed to contain at least 31.103 grams of gold.

Specifications

Physical properties

Net weight

The net weight is determined by multiplying the gross weight with with the purity. |

1 troy ounce |

| Purity and metal type | 99,99% | Gold |

Origin

| Meltery | Credit Suisse |

| Certificate of authenticity | Yes |

Price properties

| Selling price | € 3.779,00 |

| Metal worth | € 3.665,01 |

Price per gram

The price per gram is determined by dividing the sales price by the net weight. |

€ 121,50 |

Premium

The premium is determined by substracting the metal worth from the sales price. |

€ 113,99 |

| Investment score | B-label |

| VAT-rate | Investment gold |

Other specifications

| Buyback guarantee applicable | Yes - 98% |

| Pick up possible | Yes |

| Storage possible | Yes |

| Availability | Currently not in stock |

Information

1 troy ounce gold bar Credit Suisse

Credit Suisse gold bars of 1 troy ounce (31.103 grams).

Credit Suisse is an LBMA recognised bullion producer, these gold bars are tradable worldwide. Credit Suisse gold bars are sealed in a certificate showing the serial number of the bar and contain 99.99% pure gold.

The price is adjusted several times a day based on the current gold price. This involves taking a premium (mark-up) against the current gold rate. Credit Suisse gold bars are the cheapest way to invest in physical gold in the form of 1 troy ounce bars or coins. These bars are available from stock. All these bars are new and sealed in a certificate of authenticity.

Featured

- Gold bar of 1 troy ounce of pure gold

- Worldwide tradable

- Struck in 99.99% pure gold

Price chart

Investment score

Investment score

This product has a B-label (Common bullion coins and bars). This means that it is a common coin or bar that is easily tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice. Examples of coins with a B-label are coins with a lower mintage.

Label informationAn A-label means that this is one of our most common products. When purchasing physical precious metals, we advise looking at both the lowest price per gram and the lowest spread. The spread indicates the difference between the buying and selling price. An A-label signifies that this is a favorable choice when buying gold and silver.

B-label means that this is a common coin or bar, which is widely tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice.

C-label means that this is a less favorable investment choice compared to a product with a higher investment score. Products with a C-label are considered collectibles.

-Psfmhzrc-web_normal.png)