-

Securily packaged

-

Buy back guarantee

-

Tradable world wide

-

Customer rating: 9.7

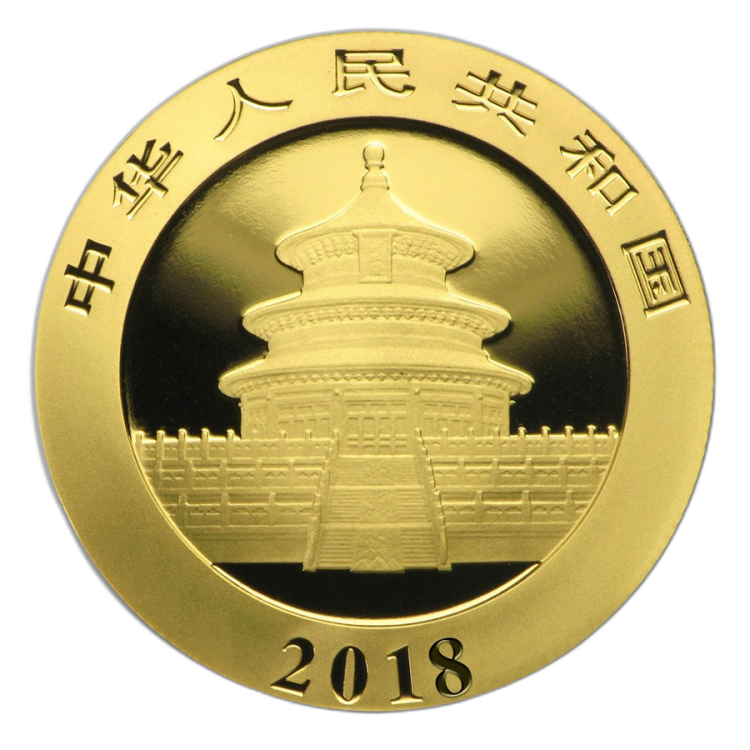

1 Gram gouden Panda munt 2017. Deze gouden munten worden door de China Gold Coin geslagen in 1 gram fijngoud (99,9%).

Specifications

Physical properties

Net weight

The net weight is determined by multiplying the gross weight with with the purity. |

1 gram |

| Purity and metal type | 99,9% | Gold |

| Condition |

Good condition

In good condition with possible superficial scratches or stains, without affecting the value or buyback guarantee. |

Origin

| Country of origin | China |

| Mint | China Gold Coin Corp. |

| Year of issue | 2018 |

Price properties

| Selling price | € 200,00 |

| Metal worth | € 148,23 |

Price per gram

The price per gram is determined by dividing the sales price by the net weight. |

€ 200,00 |

Premium

The premium is determined by substracting the metal worth and possible taxes from the sales price. |

€ 51,77 |

| Investment score | B-label |

| VAT-rate | Investment gold |

Other specifications

| Pick up possible | Yes |

| Storage possible | Yes |

| Availability | Currently not in stock |

Price chart

China Gold Coin Corp.

The China Gold Coin Corporation is the official mint of China and the only institution that deals in Chinese gold and silver coins. The China Gold Coin Corporation aims to design, manufacture, and market Chinese collectible and investment coins. The primary motif chosen is the protected panda bear, which is not only a national symbol but also the oldest ambassador of the Republic of China. The beautiful, high-quality coins are sought after worldwide, making China Gold Coin Corporation a global player in the market.

Investment score

Investment score

This product has a B-label (Common bullion coins and bars). This means that it is a common coin or bar that is easily tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice. Examples of coins with a B-label are coins with a lower mintage.

Label informationAn A-label means that this is one of our most common products. When purchasing physical precious metals, we advise looking at both the lowest price per gram and the lowest spread. The spread indicates the difference between the buying and selling price. An A-label signifies that this is a favorable choice when buying gold and silver.

B-label means that this is a common coin or bar, which is widely tradable worldwide. However, a product with this label is more expensive than a product with an A-label, so as an investment in physical gold and silver, this product is not the most cost-effective choice.

C-label means that this is a less favorable investment choice compared to a product with a higher investment score. Products with a C-label are considered collectibles.

-Idgn7UEz-small_thumb.png)